1 Jan 2023. Each of these items can be supplied separately.

An Introduction To Malaysian Gst Asean Business News

This doesnt file the return with IR.

. Ultrabook Celeron Celeron Inside Core Inside Intel Intel Logo. When you buy supplies worth 50 or less its still a good idea to get a receipt. Finalise your 31 July 2018 GST return in Xero.

1 Jan 2023. You can e-file your GST F5 one day after the end of the accounting period. Price is inclusive of 10 GST where applicable.

The prospect of a global recession on the horizon is in focus again following the US Federal Reserves sharp and unexpected 75-basis-point increase in the Fed funds rate and determination for more hikes as it steps up efforts to tame skyrocketing inflation in the countrySince early June the Fed has also embarked on quantitative tightening. John can also claim an amount that reflects the decline in value of the photocopier on his tax return. No Indian passport holders wont be able to get visa on arrival to Malaysia due to Covid restrictions in the country as of now dated 1st of February 2022Once the situation is back to normal we are expecting that government will open visa on arrival for enhancing tourism.

You need to keep the tax invoice for your GST records. Malaysia is a country in Southeast Asia located partly on a peninsula of the Asian mainland and partly on the northern third of the island of Borneo. In 2012 the Standing Committee started discussions about GST and tabled its report on GST a year later.

Sendirian Berhad Sdn Bhd Company in Malaysia Business Owners Must Know. Canadas Goods and Services Tax GST and Harmonized Sales Tax HST imposes new compliance requirements for businesses that operate outside of Canada and sell taxable digital goods to customers in Canada. It stands out even among them too.

If you want to claim the GST on these purchases you will need a record of the. Check GST rates registration returns certification and latest news on GST. Enjoy Low Prices when you buy now online.

Congress leader Shashi Tharoor on Wednesday July 20 2022 joined the meme fest on Twitter and said the WhatsApp forward is brilliant as this skewers the folly of the GST. Go ahead and register here. John can claim a GST credit of 100 on his activity statement.

You must ensure that IRAS receives your return not later than one month after the end of your prescribed accounting period. All businesses in Malaysia are required to be registered with the Companies Commission of Malaysia SSM. Which Countries other than India has GST.

In Malaysia and shall exclude the cost of transport to the place of treatment. Malaysian Immigration authorities started fingerprinting visitors on arrival and departure in and these fingerprints may well find their way to your countrys authorities or other non-state. 1 Jan 2023.

Tax invoices sets out the information requirements for a tax invoice in more detail. 1 Jan 2023. GST - Know about Goods and Services Tax in India with various types and benefits.

Lifetime Free for one-off 1500Rs GST. Malaysia Malaysia - English New Zealand Philippines - English. Selling goods or services.

Crisis 2 VAT cut on basics is withdrawn. Ensure all other transactions on the GST Audit report and adjustments are correct and complete. Taxable and non-taxable sales.

After 3 days of working I bought lifetime package plan. Looking for laptop for your home or business. Sales tax on low-value import consignments.

IRS Software is a popular POS system that was built in 2002. Try Easy for free Learn more. Composite supply under GST means if a supply is comprising two or more goods or services that are naturally bundled and sold together.

Malaysia Malaysia - English New Zealand Philippines - English Pilipinas Singapore. If GST on debtors is higher than GST on creditors. File the return with IR.

KUALA LUMPUR June 25. I started using the demo version. If GST on creditors is higher than GST on debtors.

GST State Code List PDF 29 GST state code list in excel and 33 GST State Code complete List 2022. Get started with Animate. We also support Malaysias SST.

But here are some popular options to get you started. Now it has been 4 years of using Book Keeper my accounts are always up to date. Create your own invoice template.

Recognised as one of the best POS systems in Malaysia IRS Software is a development company that goes head-to-head against even international competition. From When GST started In India. Increases GST to 8.

Mixed supply under GST is when a taxable person combines two or more individual goods or services and sell it for a single price. Explore artist stories tutorials livestream events and more. Let HP help you find the perfect laptop for all your needs and budget.

GST for the first year. GSTR 20131 Goods and services tax. Antminer S19 Pro For SaleThe Antminer S19 95TH and S19 Pro 110TH bitcoin mining machines are now being sold at our company and both models are available for shipping to the US China and MalaysiaPrices start at 2000 for the S19 and 2749 for the S19 Pro and more for the S19 XP S19J and Antminer S19 Pro Hyd.

Although the Health Minister said that the implementation of GST on April 2015 will not affect the health care industry the various by products used in healthcare services are not exempt and this has increased costs quite significantly. AustraliaCanada Malaysia Maldives New Zealand Papua New Guinea and Singapore. You should issue tax invoices when you sell goods or services.

Get inspired and get started. A Sendirian Berhad Sdn Bhd company in Malaysia is a private limited business entity which can be started by both locals and foreigners. Use our easy to use free invoice templates to get started.

With GSTN integration you can directly search GST details while creating account and generate EWay bill while creating invoice with just one click. Once you have started to e-file your GST F5 your next GST return will be made available online by the end of each accounting period. Theyve had over 30000 clients and more than 100 dealers all over Malaysia.

The SSM is the governing. Leave a Comment Cancel reply. These items cannot be sold.

In 2014 the new Finance Minister at the time. SGST and Integrated Goods and Services Rax IGST. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. GST exemption withdrawn on e-commerce imports. Even though Malaysian government starts issuing visa on arrival for Indians you would need to.

Gst In Malaysia Will It Return After Being Abolished In 2018

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst Rates In Malaysia Explained Wise

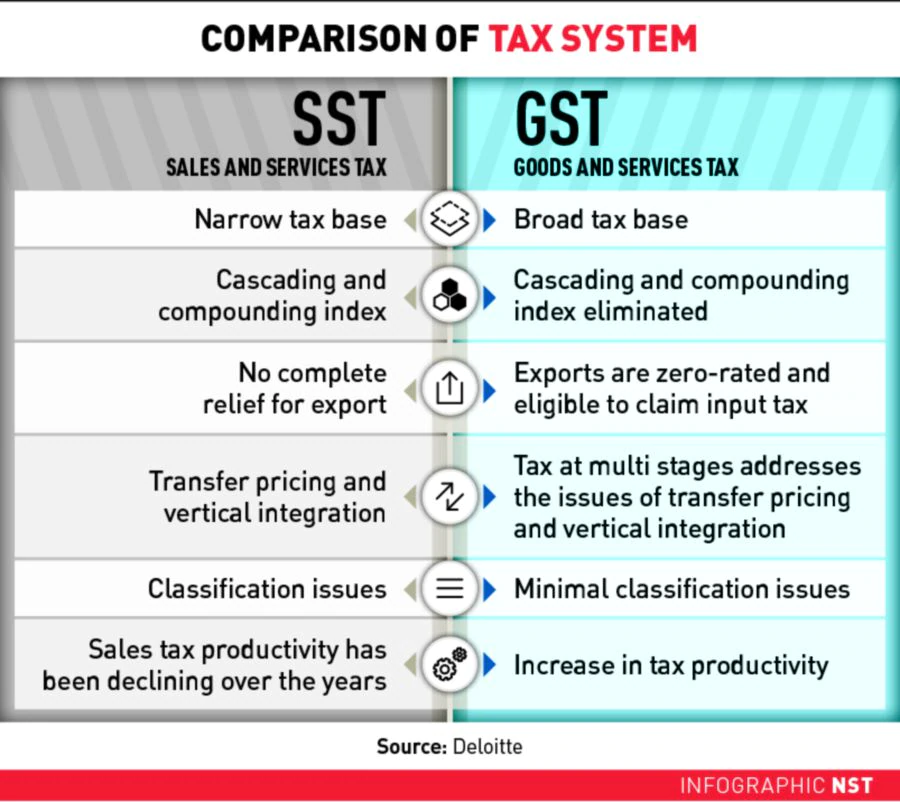

How Is Malaysia Sst Different From Gst

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

How To Start Gst Get Your Company Ready With Gst

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Brief History About Gst Goods Services Tax Gst Malaysia Nbc Group

How Is Malaysia Sst Different From Gst

Countries Implementing Gst Or Vat

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Countries Implementing Gst Or Vat

Gst Vs Sst In Malaysia Mypf My